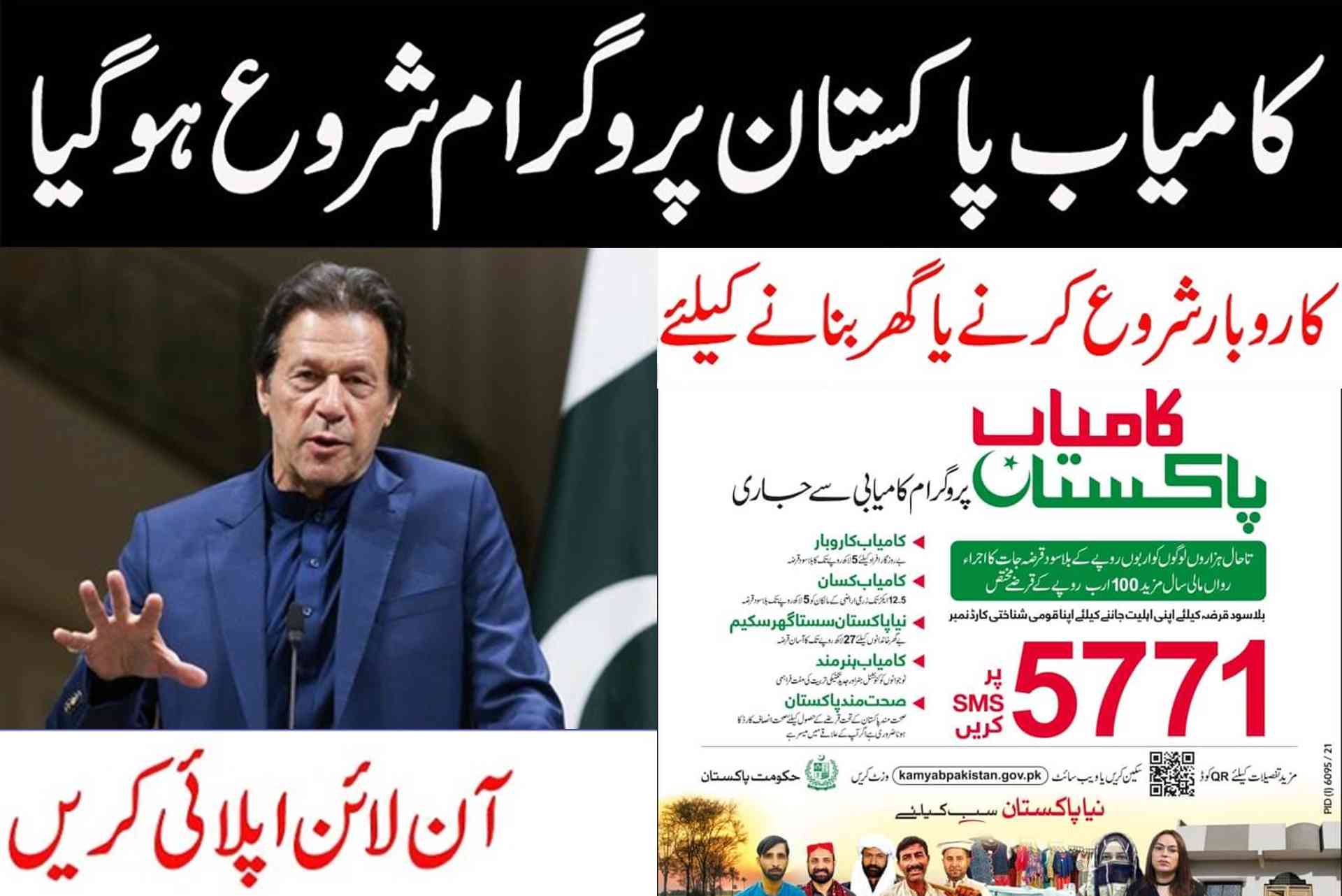

Kamyab Pakistan Program Online Registration – Prime Minister Loan Scheme 2022

The registration for the PM Kamyab Jawan Program 2022 is now open on the internet. The Kamyab Jawan offers them financial assistance free of interest and charges no interest to encourage hardworking, disciplined, and skilful business youth. This programme will encourage all male and female candidates to apply for a loan through the Kamyab Jawan Program and to take advantage of the opportunity to start their own small business.

Training on Starting and Scaling an Online Business for Young Entrepreneurs: Kamyab Jawan has announced a new training programme for young entrepreneurs on starting and scaling an online business. Kamyab Jawan, in collaboration with the United States Agency for International Development (USAID) Pakistan Regional Economic Integration Activity (PREIA), is organising in-person and virtual training sessions on leveraging e-Commerce for the benefit of Pakistani young men and women entrepreneurs. The application must be submitted by the 28th of February in 2022 to be considered.

Greetings, fellow citizens. On the Kamyab Jawan website, you can check your loan status for phase 2. Banks are currently working on application materials. It is taking longer than expected due to a large number of applications. Once the processing is complete, you will receive a call from the relevant bank.

In Balochistan, there is a man named Kamyab Jawan. The Kamyab Jawan Program, an initiative of Prime Minister Imran Khan for the youth of Balochistan, provides a plethora of scholarships, skills, and certificates. The complete set of information is provided below;

| Total Skills Scholarships Awarded | Conventional Skills Scholarships | Certifications Under RPL | High Tech Skill Scholarships |

| 5,880 | 2,824 | 2,135 | 921 |

For young Pakistanis who want to develop their athletic abilities to the national and international levels, the Kamyab Jawan Sports Drive is a great opportunity. The men’s and women’s hockey games were played at the Islamabad Sports Complex.

| HOCKEY RESULT | |

| Women’s Hockey Match | Men’s Hockey Match |

| 1st – Punjab University | 1st – Central Punjab University |

| 2nd – Superior University | 2nd – Punjab University |

| 3rd – LCWU University | 3rd – Sargodha University |

Youth Empowerment Program in Sindh: The Kamyab Jawan Programme is a youth empowerment programme in Sindh. In Sindh, Pakistan, the following scholarships, skills, and certificates are being distributed as part of the “Skills for All” initiative:

| Total Skills Scholarships Awarded | Conventional Skills Scholarships | Certifications Under RPL | High Tech Skill Scholarships |

| 19,719 | 7,242 | 2,022 | 10,455 |

Punjab: The Kamyab Jawan, through its “Skills For All” programme, aims to provide educational skills to Pakistani youth for them to advance in their current and future endeavours. Those with the following abilities and scholarships are recognised:

| Total Skills Scholarships Awarded | Conventional Skills Scholarships | Certifications Under RPL | High Tech Skill Scholarships |

| 38,142 | 14,329 | 12,835 | 10,978 |

Under the Kamyab Jawan Program (Skills for All) in Khyber Pakhtunkhwa, courses are being offered to youth to increase their exposure to the programme. Those with the following abilities and scholarships are recognised:

| Total Skills Scholarships Awarded | Conventional Skills Scholarships | Certifications Under RPL | High Tech Skill Scholarships |

| 8,991 | 4,419 | 1,101 | 3,471 |

Read Also:

- Prime Minister Internship Program 2022

- PM Sehat Insaaf Card Program Online Registration Form And Eligibility

Loan Categories for the Kamyab Jawan Program in 2022

The Kamyab Jawan loan scheme makes it possible to start a new business or keep an existing one running. This programme offers loans ranging from Rs. 10 lakh to Rs. 2.5 crore.

Tier from a single lake to tens of thousands

Please keep in mind that this tier of the Kamyab Jawan loan programme offers loans with no requirement for equity.

Tier 1: 1 lake to 10 lakh

Please Note: This tier Kamyab Jawan loan program offers loans with any equity requirements.

Tier 2: 1 Crore

Tier 3: 2.5 Crore

The PM Kamyab Jawan scheme aims to create jobs throughout Pakistan and raise Pakistan’s economic standing in the world of business and development.

Kamyab Jawan Makes an Offer for a Halal Loan:

The vast majority of applicants desire to receive a loan with no interest, which is why HALAL has designed a scheme that will provide two options. Alternative to the Islamic loan. In this case, the bank will take care of any hardware requirements you may have by the business model.

The loan from Kamyab Jawan with Interest:

The Kamyab Jawan provides loans at a rate of three per cent interest. According to the requirements of Islam, it provides a list of banks that offer loans that meet those requirements. This scheme is supported by a total of 21 different partner banks. This loan can be obtained quickly and easily, without hassles or difficulties.

Approaches to the Kamyab Jawan Program:

Obtaining a Business Loan

- Youth skill development is promoted by providing scholarships for learning new skills.

- Engaging young people in business and reducing the unemployment rate are two important goals.

- The Jawan programme, established for 20,000 small businesses, has been launched. It encourages young people to start small businesses in Tier-1, where they can gain experience.

This programme provides loans to both educated and uneducated individuals. They can start their own business without experiencing any financial difficulties.

The Kamyab Jawan programme scheme provides female entrepreneurs with 25 billion rupees in funding to start their own businesses. The goal of the Kamyab Loan Jawan programme is to encourage more women to take an active role in the development of Pakistan.

How to Submit an Application for the Kamyab Jawan Program 2022

The application process for the PM Kamyab Jawan Program 2022 will be conducted entirely on the internet. You will not be required to visit a bank to apply for a loan under this programme. The Prime Minister, Kamyab Jawan programme, will use artificial intelligence (AI) to monitor the entire process of online registration.

It will also maintain an index based on data collected from the internet. There are two options for submitting your application: either online or through a paper application form available below.

Candidates can submit information online in nine simple steps using this application form. Filling out the application form online requires completing the nine steps outlined below.

Step 1: Make a preliminary selection:

The server will ask you to enter your initial social and geographic status when you arrive at this step. For example, the candidate’s employment, business, and political standing in Pakistan are relevant factors. After you have completed the form, click on the Next button.

Step 2: Provide your personal information.

In this step, the applicant enters their personal information such as their name, gender, CNIC number, father’s name and CNIC number, and a picture of themselves from the front and back sides. After entering all of your information, click on the Next button to proceed to the next step.

Step 3: Specifics of your qualification:

The next step is to upload your academic transcripts, certificates, and photos of yourself. After completing this step, click on the Next button to proceed.

Step 4: Provide your contact information.

You will be asked to enter your address, phone number, province and district information in this step by the online server.

The fifth step is to gather business information.

In the Business Information section, you must specify your area of interest in business and all of your contact information, including the address of your company’s city or province.

Step 6: Arrangements for Financing

In this step, you will choose the type of loan, the tier type, the year, the estimated project or business cost, the loan amount, and the amount and source of equity capital.

Step 7: Develop a business plan:

It is necessary to enter all of the information related to the business model, the number of current employees, the ratio of new employees to existing employees, and the age of the business in this step. Then, after clicking on the Next button, you will be able to enter your financing history information.

Step-eight: Financial Track Record:

If you have taken out loans from other financial institutions, you must disclose this information in this step. If yes, enter the bank’s name, the loan amount, and the remaining amount, along with all of the necessary information and a picture.

Step 9: Refer to the following sources:

In the final step, the applicant must provide the names and contact information for two references who are not blood relatives and their complete bio-data, including their name, CNIC number, address, phone number, and relationship to the reference.

The declaration box will appear after you have completed all of the steps. All instructions should be carefully read before clicking the “I Agree” and submitting the application form. After all of the information has been submitted, it is impossible to make any changes. Please double-check that all of your information is entered correctly in the correct form, as any incorrect information may result in the rejection of your loan application.

Some Questions regarding about Kamyab jawan program:

Do I have to fill out an application, or do I need to register for Kamyab Pakistan?

You send SMS from 5771 Kamyab Pakistan to CNIC number.

Does Kamyab Pakistan have an upper age limit?

For KPP, there should be no upper age limit.

Can students sign up for KPP if they want to participate?

Yes, is it possible to register them as well?

To what extent does KPP leave One Family member isolated?

Only one member of a family will be eligible to receive the loan.

Kamyab pakistan loan